Are you a foreigner and planning to register a Startup Business in Thailand? Then you must know about the benefits and privileges that the Board of Investment provides to foreign startups in Thailand. This article aims to help you with all the necessary information that is mandatory for your business.

The Board of Investment benefits for startups in Thailand extends across a wide range of tax and non-tax privileges. These include investment incentives, tax holidays, and import-export duty reductions.

It is worth noting that ever after the COVID-19 pandemic, there is great growth in the digital ecosystem of Thailand. Thai natives and expats now have strong engagement and presence on social media and online purchase platforms. Identifying this trend, the Board of Investment of Thailand started supporting and promoting investment incentives for companies in the digital field.

Let us have a look at the various segment of the digital business in Thailand that holds the eligibility to get Board of Investment privileges.

ECommerce Startup Business in Thailand

eCommerce business refers to companies with the capability and authorization to buy and sell goods and services through online services to consumers on the Internet. The Board of Investment No. 4/2564 measures exclude retail and wholesale activities.

The eCommerce market of Thailand has witnessed great growth during the COVID-19 pandemic era and is continuing to grow rapidly. The value of the Thai eCommerce market before the COVID era was worth 5.16 billion USD in 2018. In 2023, it is worth 20.90 billion USD, that is, the market boomed by more than 400%. So isn’t starting eCommerce Business in Thailand going to be a great idea?

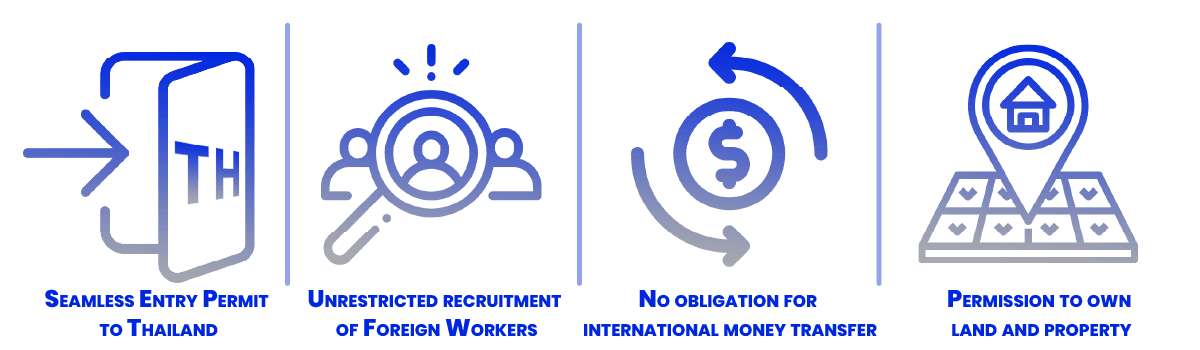

Apart from tax incentives, eCommerce businesses can benefit from the BOI non-tax incentives like the following:

- Authorization for foreign nationals to enter Thailand to study investment opportunities

- Permission to bring in qualified workers/experts to work in the Kingdom

- Permission to withdraw or remit money abroad in foreign currency

- Permission to own land for promoted projects

Software Development Startup Business in Thailand

With the boom in the digital ecosystem of Thailand, many eCommerce and digital service providers are prominently visible in the business landscape. To sustain such businesses, the presence of admin, accounting, tracking, and CRM software in the process of such companies is mandatory.

This rise in the digital industry grants opportunity for the software industry to witness great growth. Additionally, Thailand has a highly supportive and sustaining infrastructure to boost the software development process. This infrastructure includes broadband internet, network security, low power outage rates, and robust production facilities.

Therefore, if you are planning to start a software company in Thailand, now is the right time to do that. Scroll down to know the legalities!

The activities included in software development companies are divided into three activities:

- Embedded software activities

- Enterprise software and digital content activities

- High-value-added software activities

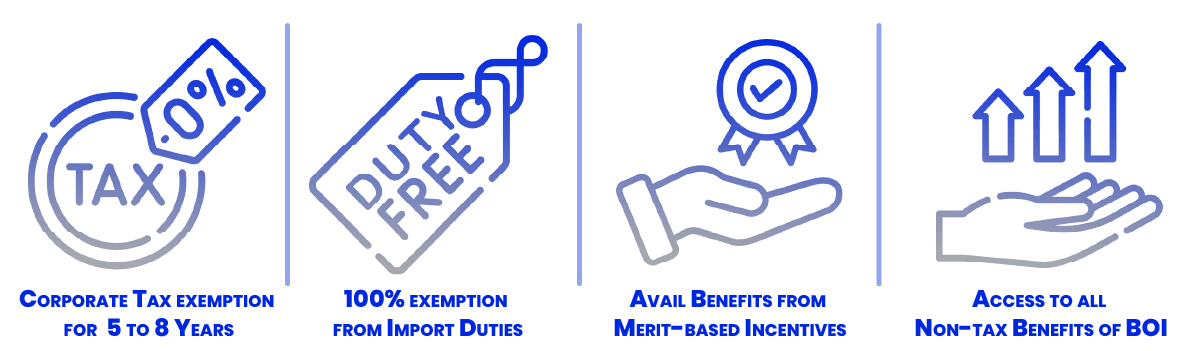

Enterprise software and digital content activities:

- Benefit from a corporate tax exemption for 5 years with a cap of 100% of the invested capital, excluding the cost of land and working capital;

- Benefit from an exemption from import duties;

- Benefit from all the non-tax incentives that come with a BOI promotion.

Embedded and high-value software business:

- Benefit from 8 years of uncapped corporate tax exemption;

- Benefit from an exemption from import duties;

- Benefit from all the non-tax incentives that come with a BOI promotion;

- Can benefit from merit-based incentives.

The general conditions for the issuance of a BOI license for a software development company are as follows:

- The minimum investment capital must be at least one million baht excluding the cost of land and working capital of the company

- The debt-to-equity ratio shall not exceed three to one for a newly established project

The project must include the software development processes specified by the Software Industry Promotion Agency (SIPA).

If the project has an investment capital of 10 million baht or more, the project must obtain a quality standard certificate from SIPA. It can also receive a Capability Maturity Model Integration quality standard certificate or other equivalent standards within 2 years from the start-up date.

Digital Services Startup Business in Thailand

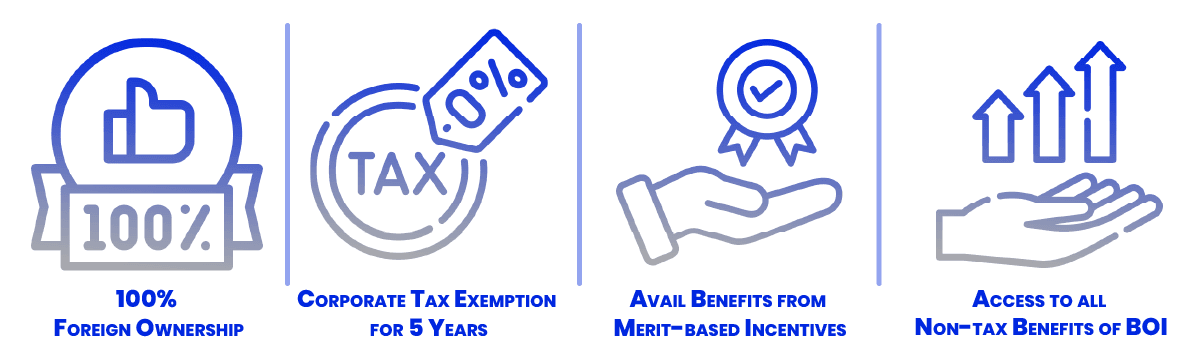

Digital Services in Thailand refer to a very wide domain. It can be digital marketing, social media advertising, online promotions, and all types of web-related services. Your startup in this industry will be eligible for BOI benefits as the following:

- Benefit from a corporate tax exemption for 5 years, with a cap of 100% of investment capital, excluding the cost of land and working capital

- Benefit from an exemption from import duties on machinery

- Benefit from non-fiscal incentives

- May benefit from merit-based incentives

In order to qualify for these incentives, the project must meet several conditions:

- The project must hire digital specialists and have a capital investment (excluding the cost of land and working capital of at least 1 million baht

- The project must include digital service processes as approved by the Council

- Projects with an investment of 10 million baht or more (excluding the cost of land and working capital) shall be certified ISO 20000 or other quality standard certificate approved by the Ministry of Information and Communication Technology within 2 years from the date of commencement of full operation

- The corporate tax exemption shall be reduced by one year

- Income from sales or provision of services that are directly related to a promoted digital service business shall be considered income of such promoted businesses

The Bottomline

By now, you must have got an idea of the privileges that startup businesses in Thailand can get from the Board of Investment of Thailand. Undoubtedly, it is a great advantage if you are able to save your taxes for 5-8 years in a foreign land. Additionally, if your business belongs to the BOI target industries, you will be eligible for more tax, non-tax, and merit-based incentives.

However, as a foreigner, it will be a wise decision if you proceed with your BOI application under the guidance of some local law firm. There are various challenges that can refrain you from getting the BOI Promotion even if your business is eligible for that. One of such major challenges is the language barrier, as Thai officials and authorities prefer to communicate in Thai rather than English.

As your one-stop partner in your startup registration in Thailand for the BOI Benefits, count on us! Email us your plan at officer@konradlegal.com. Our team of experts will get back to you within one Thai working day!